Calendar Year Close

DIFFERENCE BETWEEN CALENDAR AND FISCAL YEAR-END

A Calendar Year ends on December 31, and Fiscal Year ends whenever your tax accounting year ends. Some companies have tax accounting years that end on dates other than December 31.

Follow these steps to close for the Calendar Year.

1. COMPLETE PRELIMINARY PROCEDURES

a) You must have printed and updated the December Operating Statements with a December transaction date before you print & file your Government Form 1099's for the Owners. The 1099 values are read from the Division of Interest file so make sure you have updated your December Operating Statements before printing the 1099's. Revenue for December production normally will be received in January and therefore will be next year's 1099 values. You do not have to close the period of December to be able to print your Owner & Vendor 1099's.

b) You should release everyone from minimum withhold on the December Operating Statements so every owner will get a Government Form 1099. If you choose not to release minimum withhold for everyone then you should print the Minimum Withhold Detail report to show who was not released. See How to Use Minimum Check Amounts on how to Release Minimum Withhold amounts.

c) You must print payroll checks and update the last payroll period in December before printing W-2's.

2. PRINT & SAVE CALENDAR YEAR END REPORTS

Select Close - Calendar Year Close Reports

Print & save for your records, all of the following Reports:

Non-Released Suspense Detail Report

Minimum Withhold Detail Report

W2 Forms for Employees

If all reports are correct you can move onto the Federal and State reporting of W-2's and 1099's.

3. W-2 FEDERAL & STATE REPORTING

You will need to follow your own state guidelines for State Reporting of W-2's. Some states accept Magnetic Media Filing and some do not require a Form. Consult with your CPA for required reporting to your state. However, the I.R.S now requires E-Filing for W-2's, if your number is sufficiently large.

Complete the steps for W-2's listed below:

W-2 State Forms Magnetic Media File

4. 1099 FEDERAL & STATE REPORTING

As in W-2's, states have different methods for reporting 1099's, and you should consult with your CPA for required reporting to your state. However, the I.R.S now requires E-Filing for your 1099's, if your number is sufficiently large.

Complete the steps for 1099's listed below:

1099 State Forms & Magnetic Media File

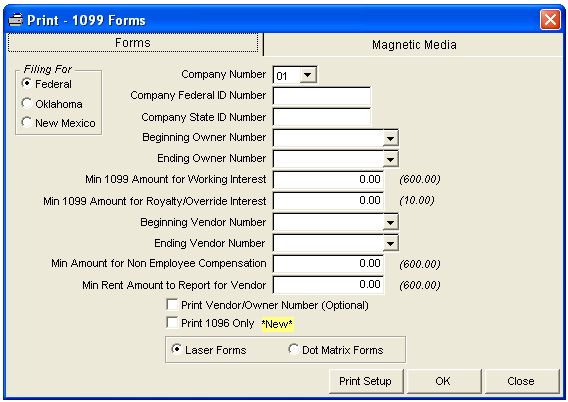

Select Close - Calendar Year Close Reports - 1099 Forms

After printing all reports and forms, you should next Zero Calendar Year values.

4. MAKE A BACKUP

Always make a Permanent Backup to a diskette, CD, or some other removable device before you Zero YTD values. Store the diskette or CD in a safe place for permanent storage. Do not rely on the temporary backup to hard disk for permanent storage.

5. ZERO CALENDAR YTD VALUES

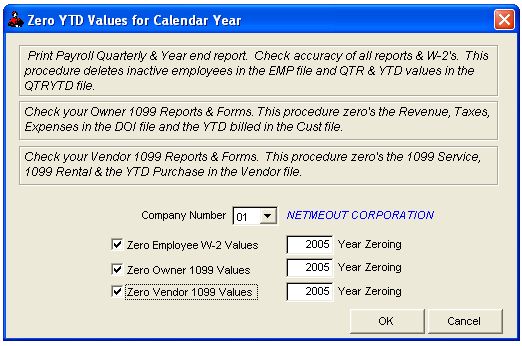

Select Close - Zero Calendar Year Values

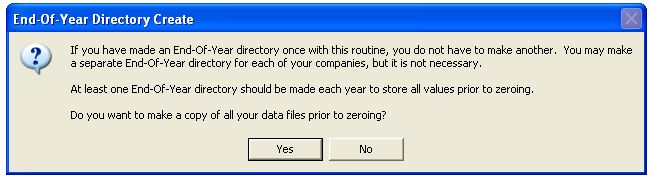

You will be prompted about making a copy of your data prior to zeroing the values. This is a good idea in case you have to later make adjusting Journal Entries furnished by your Accountant.

Click Yes.

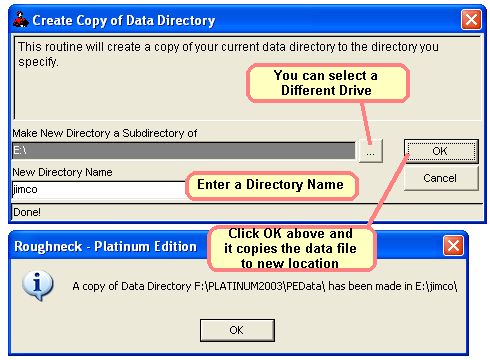

Select a Disk Drive, Enter a Directory Name, and click OK to copy the data files.

Zero year to date values for Calendar Year. See Zero Calendar YTD Values for more info.

Zero Employee W-2 Values - will zero YTD values for Employees of the company you specify.

Unless you have a backup, you can no longer print the W-2s or Payroll Year-End reports once you zero the Employee year to date values for the company.

But, you must zero the company before you can Update a payroll for the company for a New Year. You can print Checks, just don't Update until you zero. This procedure will delete inactive employees too.

Zero Owner 1099 Values - will zero the year to date values for all owners and customers in the Owner/Customer File for the specified company. Minimum withhold year to date balance will not be zeroed in the Owner/Customer File. All other values will be zeroed. Year to date values for federal tax withhold and year to date values for state tax withhold will be zeroed. It also zeros the released year to date revenue, taxes and expenses in the Division of Interest file for the specified company. Suspense values are not zeroed. No life to date fields are zeroed in either file.

Unless you have a backup, you can no longer print the 1099s or reports once you zero these values for the company.

But, you must zero Owner 1099 values before you can Update Operating Statements for the company for a New Year. You can print Operating Statements and Checks, just don't Update. If 1099 values are not zeroed and you update Operating Statements for January, the Division of Interest file would contain last year and January 1099 values. The values would have to be corrected by hand or restored from a backup. Zeroing values, after adding one more update, would zero out last years values and January

values because the closing is not date sensitive.

Zero Vendor 1099 Values - will zero the year to date values in the Vendor File for the entire company you specified. The year to date 1099 service, 1099 rental, federal withhold and state tax withhold values are stored in the Vendor file. These values are updated each time you pay an invoice.

Unless you have a backup, you can no longer print the 1099s or reports once you zero these fields for the company.

But, you must zero these fields before you can make payments to invoices for the company for a New Year. These values are updated each time you pay an invoice.

Finished Closing the Calendar Year.

ROUGHNECK REMINDERS

You should not Update for January Payroll Checks for a New Year prior to zeroing W2 values.

You should not Update for January Operating Statements prior to zeroing owner 1099 values.

You should not enter or pay Accounts Payable invoices prior to zeroing vendor year to date values.

If you have more than one company you must close the Calendar Year for each company.

Related Topics

Frequently Asked Questions about Calendar Year End

Frequently Asked Question about Fiscal Year End

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.